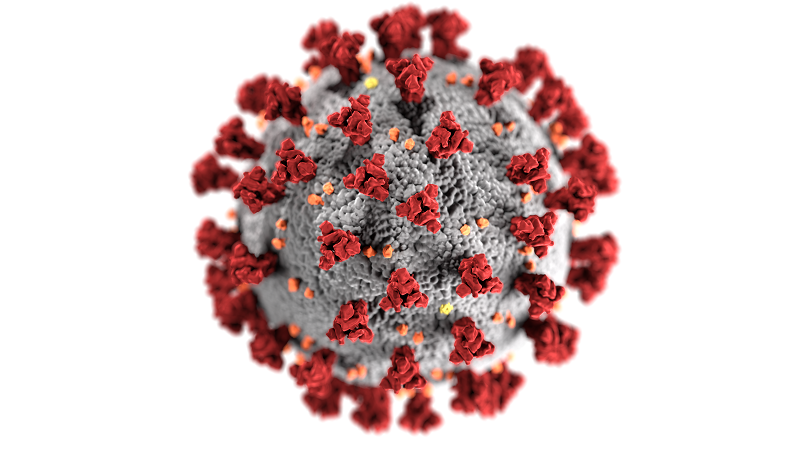

COVID-19 has been a significant determinant of investment performance since 2020. It is now one of several forces impacting returns on various types of investments, from stocks to REITs. Inflation, interest rates, recessions, energy prices, geopolitical turmoil, and the vicissitudes of the COVID pandemic have whipsawed stocks and REITs during the three-year period.

The Dow Jones Equity All REIT index posted a 41.2% return in 2021, while the S&P 500 finished the year with a return of 28.7%. However, 2022 saw the REIT index drop 28.71% versus the S&P’s loss of 19.44%.

The question is, how much impact did (and does) COVID have on the REIT market? Yonpei Cai and Kuan Xue (C&X) of Dalhousie University in Halifax, Canada, just published a timely paper entitled “Net Impact of COVID-19 on REIT Returns,” comparing COVID’s impact against that of recessions. The authors admitted surprise at their results, which showed COVID had a positive or neutral effect on some REIT sectors despite the brutal hit from the COVID pandemic.

Previous studies showed that US REIT returns derive mainly from the type and geographical distribution of REIT properties. However, these studies didn’t compare the relative impact of COVID with that of recessions upon REITs. As C&X point out, the COVID-triggered recession had some unique features:

- Governments restricted some economic activities and accelerated others. Travel bans, social distancing, work at home, grace periods on rents and foreclosures, and business lockdowns all reduced and delayed rent payments, the source of 75% of REIT gross income.

- Rapid accumulation of knowledge about the virus led to early vaccine development.

- Cooperation is required from the general public for policies that extend beyond normal monetary and fiscal responses.

- Market returns have been volatile, dating from February 2020

- Travel bans were felt keenly by retail, residential, and hospitality REITs.

The study presented findings tied to several REIT sectors. Without going into the complex mathematics, the authors used a model based on the following variables:

- REIT sectors

- REIT companies

- Time periods

- REIT returns minus three-month Treasury bill rates (i.e., REIT excess returns)

- Coefficients for recent recessionary periods

The most significant coefficient measures the net impact of the COVID-19 pandemic on REIT excess returns for each property type. Another important coefficient measures the net effect of recent recessions on REIT excess returns by property type. Combining these two coefficients measures the aggregate impact of the recession induced by COVID-19.

The researchers did not show that COVID created positive returns, only that it helped to cut losses in specific sectors.

Industrial REITs

A substantial portion of industrial REIT revenues stems from the demand for warehousing and logistical spaces. COVID boosts this demand through movement restrictions that encourage eCommerce and remote work. C&X found that COVID-19 had a positive, statistically significant impact on industrial REIT returns but that recessions had a negative, albeit statistically insignificant effect. Industrial REIT returns fell the least among the four sectors studied during the coronavirus pandemic.

Office REITs

COVID forces employees and executives to take up remote and home work. A survey from Price Waterhouse Coopers found that office workers increasingly tend to rotate in and out of hybrid workplaces. Contrary to expectations, C&X found that COVID-19 positively impacted office REIT returns, statistically significant at the level of 1%.

As expected, the net impact of recessions on office REITs was negative, and the result was statistically significant at the 5% level. Business closures, reduced office utilization, and remote work are all factors that contributed to office REIT losses.

To some extent, COVID offsets the negative impact of recessions on office REITs, perhaps due to existing office leases and percentage rent clauses for commercial properties. The clause requires a commercial space tenant to pay a base rent plus a percentage based on the business owner’s monthly sales volumes. Nonetheless, the most recent recession took a considerable toll on office REIT returns.

Residential REITs

COVID worsened the rental crisis as populations sought the supposed safety of the suburbs coupled with the convenience of working from home. In fact, the federal government created the Emergency Rental Assistance Program to ease the financial burden of households unable to pay their rent. One would expect that delays in rental payments would hurt the residential REIT market.

Once again, the researchers uncovered unexpected results regarding the impact of COVID-19, showing that returns were positive at the 1% statistical level. Recessions had a negative effect at the much more stringent 0.1% level. The results did not support the team’s hypothesis that COVID harmed residential REITs but wasn’t strong enough to rule out zero impact.

Retail REITs

Many signs point to how badly COVID affected the retail sector, especially brick-and-mortar stores. However, C&X could not disprove that COVID had zero impact on retail REIT returns. Recessions had a negative effect, but the result wasn’t statistically significant. The researchers suggest that retail REIT returns react to the long-term impact of the boom-and-bust cycle rather than recessions in isolation.

Interestingly, the researchers found that retail REIT returns are strongly correlated to inflation, credit conditions, property values, and structural changes due to recessions.

2023 REIT Outlook

The National Association of Real Estate Investment Trusts (Nareit) has looked into its crystal ball and sees better times ahead for REITs, listing these factors:

- REITs have strong balance sheets that should position themselves for 2023’s economic uncertainties.

- REITs currently use historically low amounts of leverage and boast of well-structured and -termed debt.

- By reducing leverage, REITs have lowered expenses relative to net operating income.

- The combination of strong balance sheets and low leverage makes REITs formidable competitors for property purchases.

Fidelity Investments holds out hope for residential rentals in 2023 because “renting is currently much more affordable than buying in many parts of the country.” It also sees REIT prices stabilizing as interest-rate increases slow down.

As for COVID-19, a new, deadly strain will undoubtedly have a negative, perhaps devastating, impact on REITs in 2023. However, the scientific community has developed protocols to create new vaccines quickly and effectively. REITs also must contend with continuing economic uncertainty, inflation, and high interest rates. It appears that REITs have strengthened their ability to withstand exogenous shocks and are a prudent asset class for investors looking to diversify their portfolios.

No related posts.

I thoroughly enjoyed the work that you have accomplished here. The sketch is elegant and your written material is stylish as well. However, you may develop a sense of apprehension regarding the delivery of the following; however, you will undoubtedly revisit since the situation is virtually identical if you safeguard this hike.

Hey Guys,

Warning: From February 2024, all existing email autoresponders will become obsolete!

In fact, if you want to send marketing emails, promotional emails, or any other sort of emails starting in February 2024, you’ll need to comply with Gmail’s and Yahoo’s draconic new directives.

They require regular marketers like you and I to setup complex code on sending domains… and existing autoresponders like Aweber and GetResponse are not helping: they’re requesting you do all the work, and their training is filled with complex instructions and flowcharts…

How would you like to send unlimited emails at the push of a button all with done-for-you DMARC, DKIM, SPF, custom IPs and dedicated SMTP sending servers?

What I mean by all of that tech talk above, is that with ProfitMarc, we give you pre-set, pre-configured, DONE-FOR-YOU email sending addresses you can just load up and mail straight away.

We don’t even have any “setup tutorials” like other autoresponders either, because guess what: we already did all the setup for you!

All of our built-in sending addresses and servers are already pre-warmed with Gmail and Yahoo and they’re loving us: 99% inbox rate is the average!

⇒ Grab your copy here! ⇒ https://ext-opp.com/ProfitMarc

Wow, marvelous weblog structure! How long have

you ever been running a blog for? you made running a blog look easy.

The total glance of your site is fantastic, as smartly as the content material!

You can see similar here e-commerce

BIG NEWS: there’s a brand new software being launched today that legally tricks AI chatbots into recommending YOUR website.

Go check it out here ==>> https://ext-opp.com/ProfitSGE

That’s right: Just imagine…there’s 1.5 billion people using AI chatbots every day.

What if every time someone…

-> Searched for “best laptops for my needs”… the AI would show them your website?

-> Asked ChatGPT for “best doctors in my city”… it would send them to your local client’s business?

-> Begged Google Gemini for “FAST weight loss”… you guessed it, Gemini would FORCE them to visit your site, display your affiliate offer and fill your pockets full of sales!

This is a TRAFFIC & SEO revolution unlike anything that’s ever come before.

This is YOUR chance to legally “hijack” traffic from 1.5 billion AI chatbots users and funnel it straight to any offer, site, product – for yourself or your clients!

Get your copy here ==>> https://ext-opp.com/ProfitSGE

A.I Create & Sell Unlimited Audiobooks to 2.3 Million Users – https://ext-opp.com/ECCO

A person essentially lend a hand to make seriously posts I would state. This is the very first time I frequented your web page and to this point? I amazed with the research you made to make this particular post amazing. Magnificent process!

A.I Create & Sell Unlimited Audiobooks to 2.3 Million Users – https://ext-opp.com/ECCO

Create Stunning Ebooks In 60 Seconds – https://ext-opp.com/AIEbookPal

Great beat ! I would like to apprentice at the same time as

you amend your site, how could i subscribe

for a blog web site? The account helped me a applicable deal.

I have been a little bit familiar of this your broadcast offered vivid clear idea I saw similar here:

Sklep internetowy

Millions of Free Traffic with AI Tools – https://ext-opp.com/AIVault

This Dude Creates Bitc0in Out Of Thin Air [CRAZY]

I didn’t believe it either at first…

Until i saw it works in action >> https://ext-opp.com/Coinz

You see, Bitc0in and the entire Crypt0 market is about to go through the rough…

Some smart people will get in now, and make massive gains,

And some will stand and watch people make money…

Ultimately, I want you to get in now…

But here is the issue…

If you put any kind of money in it now, it would be a huge risk.

Especially if you put in money that you can’t afford to lose…

But what my friend, Seyi, did is insane…

He created the world’s first AI app that literally generates Bitc0in and ETH out of thin air…

All you need to do is just connect your wallet, and that’s it…

– You don’t need to analyze the market

– You don’t need mining equipments

– You don’t need to trade

– And you don’t need to invest even a penny

To create your account with Coinz, and start receiving daily Bitc0in & etheruem for 100% free click here >> https://ext-opp.com/Coinz

But don’t delay, because the price of Coinz will double very soon…

Cheers

This Dude Creates Bitc0in Out Of Thin Air [CRAZY]

I didn’t believe it either at first…

Until i saw it works in action >> https://ext-opp.com/Coinz

You see, Bitc0in and the entire Crypt0 market is about to go through the rough…

Some smart people will get in now, and make massive gains,

And some will stand and watch people make money…

Ultimately, I want you to get in now…

But here is the issue…

If you put any kind of money in it now, it would be a huge risk.

Especially if you put in money that you can’t afford to lose…

But what my friend, Seyi, did is insane…

He created the world’s first AI app that literally generates Bitc0in and ETH out of thin air…

All you need to do is just connect your wallet, and that’s it…

– You don’t need to analyze the market

– You don’t need mining equipments

– You don’t need to trade

– And you don’t need to invest even a penny

To create your account with Coinz, and start receiving daily Bitc0in & etheruem for 100% free click here >> https://ext-opp.com/Coinz

But don’t delay, because the price of Coinz will double very soon…

Cheers

After Generating Millions Online, I’ve Created A Foolproof Money Making System, & For a Limited Time You Get It For FREE… https://ext-opp.com/RPM

synthroid 0.175

ChatGPT powered Autoresponder with Free SMTP at Unbeatable 1-Time Price! https://ext-opp.com/NewsMailer

ChatGPT powered Autoresponder with Free SMTP at Unbeatable 1-Time Price! https://ext-opp.com/NewsMailer

Wow, marvelous blog structure! How long have you ever been blogging for?

you made blogging glance easy. The overall look of your web site

is magnificent, let alone the content! You can see similar here najlepszy sklep

valtrex daily

An Ultimate Web-Hosting Solution For Business Owners https://ext-opp.com/HostsMaster

MobiApp AI – True Android & iOS Mobile Apps Builder (Zero Coding Required) https://ext-opp.com/MobiAppAI

Wow, fantastic weblog layout!

How lengthy have you been blogging for? you made running a blog

look easy. The overall glance of your website is great, as well as the content!

I read similar here prev

next and that was

wrote by Ardith00.

buy azithromycin uk

where to get valtrex

Word’s First NLP & ML Based Email, Voice & Video Marketing Autoresponder Thats Boost Email Delivery, Click & Open Rates Instantly https://ext-opp.com/VidMailsAI

Word’s First NLP & ML Based Email, Voice & Video Marketing Autoresponder Thats Boost Email Delivery, Click & Open Rates Instantly https://ext-opp.com/VidMailsAI

buy valtrex online cheap

Are you still using Calendly to schedule your calls and meetings?

If your answer is yes, then you are actually hurting your business not helping it…

Calendly is limited, doesn’t unlock the full potential of your business…

And to make matters worse, they charge you monthly…

What a joke…

But you don’t have to worry, because my good friend Kundan is about to change the entire market …

You see, he just launched his newest creation AI Calenderfly…

The world’s first appointment-setting app that is fully powered by AI…

It will do all of the heavy lifting for you on complete autopilot…

AI meeting scheduling

AI reminders

AI tracking

And much much more

You can even accept payments live, and collect leads…

But it gets even better…

You don’t have to pay a penny in monthly fees…

Click here to watch AI Calenderfly in action and secure your copy at the lowest price possible… https://ext-opp.com/AICalendarfly

Are you still using Calendly to schedule your calls and meetings?

If your answer is yes, then you are actually hurting your business not helping it…

Calendly is limited, doesn’t unlock the full potential of your business…

And to make matters worse, they charge you monthly…

What a joke…

But you don’t have to worry, because my good friend Kundan is about to change the entire market …

You see, he just launched his newest creation AI Calenderfly…

The world’s first appointment-setting app that is fully powered by AI…

It will do all of the heavy lifting for you on complete autopilot…

AI meeting scheduling

AI reminders

AI tracking

And much much more

You can even accept payments live, and collect leads…

But it gets even better…

You don’t have to pay a penny in monthly fees…

Click here to watch AI Calenderfly in action and secure your copy at the lowest price possible… https://ext-opp.com/AICalendarfly

zithromax cost uk

Wow, aawesome bllog layout! How long hawve youu bwen blogging for?

youu made blogging look easy. Thee overall lokok off yoyr sikte iis fantastic, llet alkne

tthe content!

Вы мечтаете о незабываемом отдыхе на озере Байкал? Ищете идеальные путевки на этот удивительный уголок природы? Тогда FanatBaikala.ru – ваш верный помощник в этом! Здесь вы найдете самые привлекательные предложения на путевку на озеро Байкал.

FanatBaikala.ru предлагает разнообразные варианты отдыха на Байкале, чтобы удовлетворить даже самые взыскательные потребности. От увлекательных экскурсий до спокойного отдыха на берегу – здесь каждый найдет что-то по своему вкусу.

Путевки на Байкал через FanatBaikala.ru – это гарантированный отдых без лишних забот. Вам останется лишь наслаждаться красотами этого удивительного места, выбрав самую подходящую путевку на Байкал для вас и вашей семьи.

synthroid 5 mcg

При ремонте моего дома я решил установить кованые перила. Важным критерием выбора была стоимость за погонный метр, чтобы соответствовать бюджету проекта. На сайте a-kovka.ru я нашел подробную информацию о ценах и различных вариантах перил. Отношение цены к качеству оказалось идеальным. Мастера сумели предложить решение, которое соответствовало как моим эстетическим, так и финансовым ожиданиям. Благодаря их работе, моя лестница приобрела изысканный и безопасный вид, который ежедневно радует глаз.

Добро пожаловать в кузницу “А-ковка” купить кованые перила – ваш надежный партнер в создании красивых и функциональных перил для вашего дома. Мы находимся в Москве, всего в 91 километре от МКАД, и готовы предложить вам широкий выбор кованых изделий, выполненных опытными мастерами.

Наша цена доступна для любого покупателя, а качество наших изделий всегда остается на высоте. Мы используем современное оборудование и материалы высокого качества, чтобы каждый заказчик остался доволен результатом. Кованые перила не только придают вашему интерьеру изысканный вид, но и являются прочным и долговечным решением для вашего дома. Закажите перила в нашей кузнице и убедитесь сами в высоком качестве наших изделий!

can you buy valtrex over the counter in canada

azithromycin over the counter usa

Absolutely pent subject matter, appreciate it for selective information .대출

Absolutely pent subject matter, appreciate it for selective information .대출

I’m blown away by the depth of your research.급전

Your writing style is both engaging and informative.급전

Your article is a valuable resource for anyone interested in this subject.급전

Шлюхи Москвы devkiru.com

По теме проститутки мичуринский проспект Вы на правильном пути. Наш проверенный интернет портал предлагает лучший отдых 18 плюс. Здесь есть: индивидуалки, массажистки, элитные красотки, частные интим-объявления. А также Вы можете отыскать нужную девушку по параметрам: по станции метро, по возрасту, росту, цвету волос, стоимости. Всё для Вашего удобства.

Путаны Москвы devkiru.com

По запросу проститутки севастопольский проспект Вы на нужном пути. Наш проверенный интернет ресурс доставляет превосходный отдых 18 плюс. Здесь есть: индивидуалки, массажистки, элитные красавицы, частные интим-объявления. А также Вы можете отыскать желаемую девочку по параметрам: по станции метро, по возрасту, росту, цвету волос, карте. Всё для Вашего комфорта.

I appreciate the time and effort you’ve put into this article.대출

Thank you for making me see things differently.급전

Когда я встретил ее на вечеринке в центре Москвы, сразу было видно, что она привыкла к роскоши и богатству. Ее изысканный наряд, дорогие украшения и аромат дорогого парфюма создавали вокруг нее атмосферу изысканности и роскоши.

Мы начали общаться, и я быстро понял, что она ценит те же ценности, что и я – роскошь, комфорт и красоту. Когда я предложил ей отправиться в Дубай на неделю, чтобы насладиться шикарными отелями, роскошными ресторанами и бескрайними пляжами, она согласилась без колебаний.

В Дубае наша любовь расцвела на фоне бесконечного блеска и роскоши. Мы катались на верблюдах по пустыне, купались в искусственных оазисах и наслаждались закатами над Аравийским заливом. Каждый день приносил нам новые впечатления и эмоции, и я чувствовал, что наша связь становится все крепче.

Несмотря на все богатство и роскошь, которые нас окружали, я понимал, что наше знакомство основано не только на материальных ценностях, но и на искреннем взаимопонимании и чувствах. И хотя наш отпуск в Дубае подошел к концу, наши воспоминания о нем останутся в моей памяти навсегда.

Твоя идеальная пара ждет тебя на этих сайтах знакомств!

https://kashikoiscissors.com/rock-casual-this-summer/#comment-21532

https://indosaranatravel.com/2022/07/01/3-best-nature-weekend-tour-in-japan/#comment-5391

http://fortelabels.com/product/products-moving1/#comment-15062

https://www.fitnesscenter-schardt.de/training/#comment-2991

https://blog.buupe.com/posts/10-coisas-que-voce-precisa-saber-antes-de-vender-conteudo-na-internet/#comment-1082

https://plastipak.co.za/curabitur-malesuadas-nisi-2/#comment-16553

https://www.snackmeter.com/a-perfect-gift-basket-for-asian-family/#comment-662

https://www.quu.at/about/#comment-45500

https://www.drukkr.com/author/robin/

https://xn--aitorpealba-7db.com/un-psicologo-va-al-cine-batman-begins-c-nolan-2005#comment-15230

Однажды я решил, что пора разнообразить свою жизнь и попробовать что-то новое. Москва – город возможностей, и почему бы не начать с знакомств? Я зарегистрировался на сайте, где обещали много интересных людей, и начал исследовать его возможности.

Сразу же меня заинтриговали многочисленные анкеты красивых девушек с самыми разными интересами. Я решил, что именно здесь я найду приключения и увлекательные встречи. И не ошибся.

Мои вечера стали наполнены захватывающими чатами с умными и обаятельными собеседницами. Мы обсуждали все – от искусства до путешествий, от кулинарных экспериментов до философских размышлений. Каждая новая беседа приносила мне массу удовольствия и эмоций.

Но особенно я запомнил одну встречу. Это была ночь незабываемых приключений с Анной, девушкой, которая умело смешивала в себе дерзость и нежность. Мы гуляли по ночному городу, разговаривали о всем на свете и наслаждались моментом. Хотя наши отношения были кратковременными, эта ночь останется в моей памяти навсегда.

В итоге, я понял, что флирт на сайтах знакомств – это не просто способ провести время, а настоящее приключение, которое приносит море эмоций и впечатлений. И я готов продолжать исследовать этот мир с каждым новым человеком, которого встречу здесь.

Хочешь встречаться с красотками? Эти сайты для тебя!

https://jknewslive.com/2023/07/20/date-sheet-bg-6th-semester-regular-fresh-private-candidates-batch-2020-backlog-candidates-batch-2016-19/#comment-31583

http://lvmin.ltd/?p=1#comment-2507

https://www.rapidseo.sk/ahoj-svet/#comment-1554

https://moortownplastering.co.uk/uncategorised/hello-world/#comment-2730

https://www.etipon.com/2023/03/19/%f0%9f%a5%b3-bienvenidos-a-etipon-%f0%9f%a5%b3/#comment-699

https://blog.jasonkleinhenz.com/2020/10/09/cbd-and-me/comment-page-245/#comment-289082

https://blogboxs.com/merry-christmas/#comment-425

https://nirvishijawaheer.ca/projects-archive/getting-started-2/#comment-47528

https://baanthai.rs/otkrijte-cari-tajlanda-u-beogradu/#comment-3275

https://boccato.travel/our-guide-answers-your-top-questions/#comment-10057

I’m inspired by your passion for this subject.급전

It’s very interesting! If you need help, look here: link building

I’m bookmarking this for future reference.급전

The content here is top-notch, and I have a hunch you’d find MOMO to be a really useful resource too.

Холодильник Gaggenau вышел из строя? Наш сервисный центр обеспечивает надежный ремонт холодильников Gaggenau с использованием оригинальных деталей. Звоните нам для быстрого и качественного обслуживания.

Стремитесь к успеху в карьере и хотите обеспечить себе высокий доход? Наш сервис предлагает вам купить диплом высшем Гознак, который обладает высоким качеством и признанием на рынке труда. Если же вам интересны ретро-варианты, вы можете купить старый диплом техникума. Наши дипломы – ваш ключ к успешной карьере и достойной заработной плате. Выбирая нас, вы выбираете надежность и профессионализм, подтвержденные множеством довольных клиентов.

Thanks for the valuable information. This is very helpful.nexusnook

retin a gel australia

batmanapollo.ru

В современном мире время — это один из самых ценных ресурсов. Почему бы не начать свою карьеру уже сегодня, экономя годы обучения? Наш сервис предлагает уникальную возможность купить дипломы о высшем образовании, которые откроют перед вами двери к успешной профессиональной жизни. Благодаря нашим документам, вы получите доступ к лучшим вакансиям и сможете заслужить уважение в обществе. Мы гарантируем 100% подлинность дипломов, полную конфиденциальность и оперативную доставку. Не упустите шанс дипломы купить и расширить свои карьерные возможности на международном уровне. Начните новый этап в своей жизни с качественным образованием, которое поможет вам расти и развиваться в выбранной профессиональной сфере.

dark market url https://mydarkmarket.com/ – darknet drug links drug markets onion

У тебя проблемы с холодильником Gaggenau? Не беда! Наш Гаггенау сервисный центр Москва решит все твои проблемы быстро и качественно. Звони нам прямо сейчас!

Contumacia cumulat poenam — прав. Упорство усугубляет наказание.

Ad usum externum — Для внешнего употребления.

This article was exactly what I was looking for. Excellent work!coinsslot

Amabilis insania — Приятное безумие.

Abstractum pro concreto — Общее вместо частного.

Abyssus abyssum invocat — Бездна взывает к бездне

Absit verbo invidia — Не взыщите на слове.

Concordet sermo cum vita — Пусть речь соответствует жизни.

Causa finita est — Дело кончено, вопрос решён.

Психолог консультация

where to get azithromycin over the counter

Если вам срочно нужны деньги и вы не хотите получать отказы, зайдите на mikro-zaim-online.ru. Мы собрали для вас список новых и малоизвестных МФО 2024 года, которые выдают займы на карту абсолютно всем. Наши специалисты ежедневно обновляют информацию, чтобы вы могли найти самые выгодные и доступные предложения. МФО, представленные на нашем сайте, предлагают быстрые и удобные займы без лишних проверок и отказов. Посетите mikro-zaim-online.ru и найдите подходящий займ прямо сейчас!

Хотите получить займ без отказа? mikro-zaim-online.ru предлагает вам отличные решения! Мы собрали новые и малоизвестные МФО 2024 года, которые гарантированно выдают займы на карту всем. Эти компании проверены нашими экспертами и предлагают самые выгодные условия. На нашем сайте вы найдете множество вариантов займов, которые помогут решить ваши финансовые проблемы быстро и без лишних хлопот. Посетите mikro-zaim-online.ru и убедитесь сами, что получить деньги стало проще!

dark markets https://mydarknetmarketlinks.com/ – deep web markets dark web market list

darkmarket link https://mydarknetmarketlinks.com/ – dark website darkmarkets

Ночью понадобились деньги на оплату срочной доставки. Нашел телеграм-канал новые и малоизвестные МФО 2024, где представлена подборка малоизвестных МФО 2024 года, работающих круглосуточно и выдающих займы даже с плохой кредитной историей. Оформил заявку и моментально получил деньги на карту. Благодаря этому смог вовремя оплатить доставку. Рекомендую этот канал всем, кто ищет быстрый займ в любое время суток!

О культуре и новые книги по психологии.

provigil online pharmacy

You consistently produce high-quality content that is both informative and enjoyable to read. This post was no exception. Keep it up!pulsepeak

Наступил день рождения у близкого друга, а я не успел накопить на подарок. На помощь пришёл телеграм-канал новые и малоизвестные МФО 2024, где собраны МФО, предлагающие займы на карту без отказа и круглосуточно. Оформив заявку, я быстро получил деньги, даже несмотря на свою плохую кредитную историю. Это позволило мне купить отличный подарок и порадовать друга. Очень благодарен каналу за оперативную помощь и рекомендую всем, кто ищет быстрый займ.

https://143.198.92.123/ | mainaja

На нашем канале только проверенная информация о новых МФО 2024. Получите займ от 1 до 30 рублей на 30 дней без отказов. Минимальные требования – паспорт и именная банковская карта. Подписывайтесь и будьте в курсе всех выгодных предложений!

Per aspera ad astra

I love how you present information in such a clear and engaging way. This post was very informative and well-written. Thank you!peakpulsesite

Добро пожаловать в наш Telegram-канал! Здесь вы найдете ежедневно обновляемую информацию о новых МФО. Все организации проверены и работают официально. Узнайте о мфо без отказа новые только открывшиеся. Займы доступны всем от 18 лет без отказа. Наши специалисты помогут вам выбрать самый выгодный и удобный вариант. Подписывайтесь на наш канал и будьте в курсе самых свежих предложений каждый день!

Dictum – factum

Ищете выгодные предложения по займам? На нашем канале вы найдете новые МФО 2024, которые предоставляют займы на карту даже с плохой кредитной историей. Минимальные требования и быстрый перевод на карту. Подписывайтесь и оформляйте займ уже сегодня!

Фильм 100 лет тому вперед смотреть онлайн бесплатно. 100 лет тому вперед фильм 2024 смотреть.

100 лет тому вперед смотреть онлайн бесплатно в хорошем. 100 лет тому вперед фильм смотреть.

Лучшие книги по саморазвитию и советы по их применению ждут тебя на канале https://t.me/s/razvisam/. Узнай, как начать саморазвитие с пользой для себя и достигать своих целей. Подписывайся и развивайся вместе с нами!

Наш Telegram-канал – ваш проводник в мире онлайн займов. Мы ежедневно обновляем список новых МФО, чтобы предложить вам самые актуальные и выгодные условия. Узнайте больше о займы на карту онлайн новые с акциями под 0%. Даже если у вас плохая кредитная история, вы сможете получить займ без отказа. Мы расскажем, как правильно использовать онлайн займы, чтобы избежать проблем. Подписывайтесь на наш канал и получайте деньги быстро и без лишних вопросов!

Король и шут кино

Получил предложение о работе мечты, но для переезда в другой город нужны были деньги. Воспользовавшись Займы без процентов на карту , я быстро нашел подходящий займ и осуществил свою мечту. Новая работа открыла передо мной невероятные возможности, и я рад, что не упустил этот шанс.

Однажды друзья пригласили меня в спонтанное путешествие. Я не хотел упускать такую возможность, но денег не хватало. На помощь снова пришел телеграм-канал малоизвестные МФО без отказов . Быстро оформил займ под 0% и через час был готов к поездке.

Майор Гром: Игра 2024

Моей маме исполнилось 60 лет, и я хотел сделать ей особенный подарок. Для этого потребовалась небольшая сумма, которую я нашел на новые МФО 2024 без отказа . Удивило, как быстро и легко можно получить деньги, даже с не самой лучшей кредитной историей. Подарок удался, и мама была в восторге.

propecia 2017

Your blog is a wealth of information. I always learn something new from your posts. This one was particularly enlightening. Great job!blogpulse

Благодарствую за полезную инфу!

В свою очередь предлагаю сыграть на настоящие деньги!

vavada онлайн — быстро и просто. Это допустит вас к к огромному количеству слотов и рулетке.

Создав аккаунт вы попадете в свой ЛК и начать играть. Обратите внимание, что для вывода выигрышей вам необходимо будет пройти верификацию аккаунта, показав документы, которые у вас запросят.

At MCI Clinic, we provide outstanding glaucoma treatment, ensuring you regain and maintain good vision. Our experienced team uses cutting-edge technology to diagnose and manage glaucoma effectively. With a range of treatments, including medications, laser therapy, and surgery, we tailor our approach to meet your specific needs.

Choosing MCI means trusting experts who prioritize your eye health and deliver top-notch care. Our commitment to using advanced methods and equipment ensures that your vision remains clear and healthy for years to come.

MCI Clinic – glaucoma

I was suggested this web site via my cousin. I’m now not sure whether this post is written via him as no one else know such certain about my difficulty.

You are incredible! Thanks!

zithromax 250mg tablets

At MCI Clinic, we offer comprehensive astigmatism treatment, combining extensive experience, top-tier equipment, and affordable pricing. Our experts use advanced diagnostic tools to accurately measure the degree of astigmatism and provide tailored correction options, including glasses, contact lenses, and refractive surgery. Our personalized approach ensures the best possible visual outcomes for each patient.

Choosing MCI means receiving high-quality care without excessive costs. We are dedicated to improving your vision and quality of life through effective, budget-friendly astigmatism treatments.

MCI Clinic – operatia miopie

Уэнздей 2 сезон смотреть онлайн

Хотите получить займ без проверок и отказов? Добро пожаловать в телеграм-канал всем деньги ! Здесь вы найдете МФО, выдающих деньги без проверки кредитной истории. Первый займ под 0% до 15 000 рублей всего за 10 минут! Также в канале есть списки новых МФО 2024 года, которые предоставляют мгновенные микрозаймы даже с плохой кредитной историей и просрочками. Подпишитесь и решите свои финансовые вопросы легко и быстро!

l free to adjust these comments as needed to better fit the specific blog posts you’re responding to!dashdome

At MCI Clinic, we specialize in cataract treatment with extensive experience, state-of-the-art equipment, and affordable prices. Our skilled professionals perform advanced procedures such as phacoemulsification, ensuring precise removal of the cloudy lens and its replacement with a high-quality artificial one. The surgery is quick, safe, and minimally invasive, providing excellent outcomes for our patients.

Choosing MCI means benefiting from top-tier medical care without the high cost. We are committed to restoring your clear vision and improving your quality of life through effective, cost-efficient cataract treatments.

MCI Clinic – лечение дальнозоркости

Проведем СОУТ в Москве safetysystemsgroup.com

Компания Safety Systems проводит спец оценку условий труда на любом предприятии. Наш главный офис находится в Москве, но также в большинстве регионов РФ у нас есть филиалы. Проверка осуществляется в обязательном порядке для всех организаций, чтобы обеспечить безопасность для сотрудников и уменьшить шансы на приобретение штрафов.

От нас специальная оценка условий труда – от Вас звонок в нашу компанию. Находимся по адресу: 105264, г. Москва, ул. Верхняя Первомайская, д. 47, к. 11, оф. 516. У нас личная аккредитованная лаборатория, которая поможет Вам сэкономить до 80 % от конкурентной стоимости. Звоните, приходите и тогда мы скорее приступим к работе.

order furosemide without prescription

Нужны деньги срочно? Вступайте в наш телеграм-канал займ на карту всем ! У нас собраны МФО, которые дают деньги без отказов и проверки кредитной истории. Воспользуйтесь предложением первого займа под 0% до 15 000 рублей за 10 минут! Также в канале найдете списки новых МФО 2024 года, где можно получить мгновенные микрозаймы, даже если у вас плохая кредитная история или просрочки. Подпишитесь сейчас и решите свои финансовые проблемы!

Your blog is a wealth of information. I always learn something new from your posts. This one was particularly enlightening. Great job!blogpulse

Внеплановая спец оценка условий труда safetysystemsgroup.com

Организация Safety Systems осуществляет специальную оценку условий труда на любом предприятии. Наш главный офис находится в Москве, но также в большинстве городов РФ у нас имеются филиалы. СОУТ проводится в обязательном порядке для всех фирм, чтобы снабдить безопасность для сотрудников и уменьшить вероятность на приобретение штрафов.

По вопросу специальная оценка рабочих мест переходите на наш веб портал. Оценочные мероприятие должны осуществляться в организациях не реже, чем раз в 5 лет. Но также у отдельных отраслей есть личные сроки. Обязательно ознакомьтесь с тем, что необходимо конкретно Вам на сайте safetysystemsgroup.com уже сейчас.

Hello there! This is my first visit to your blog!

We are a collection of volunteers and starting a

new initiative in a community in the same niche.

Your blog provided us beneficial information to work on. You have done a

wonderful job!

Холодильник Bosch не работает? Обратитесь к нам для ремонта холодильников Bosch. Наши мастера приедут на дом, проведут диагностику и быстро устранят любую поломку. Мы используем только оригинальные запчасти.Ваш холодильник Бош не работает? Наши мастера с более чем 10-летним опытом проведут ремонт холодильников Бош на дому. Мы используем только оригинальные запчасти и предлагаем бесплатный выезд мастера для диагностики и устранения проблем.

Лаборатория труда соут safetysystemsgroup.com

Организация Safety Systems реализует специальную оценку условий труда на каждом предприятии. Наш основной офис расположен в Москве, но ещё в большинстве городов РФ у нас имеются филиалы. Проверка проводится в обязательном порядке для всех фирм, чтобы снабдить безопасность для работников и убавить вероятность на получение штрафов.

В отношении провести соут заходите на наш веб портал. Оценочные события должны проходить в компаниях не менее, чем раз в 5 лет. Но еще у отдельных отраслей есть личные сроки. Обязательно ознакомьтесь с тем, что нужно конкретно Вам на сайте safetysystemsgroup.com прямо сейчас.

vermox drug

Обеспечьте надежность своей техники с помощью Бош сервис. Наши квалифицированные специалисты предоставляют профессиональное обслуживание и ремонт бытовых приборов Bosch. Мы гарантируем оперативность и качество выполнения всех работ, используя только оригинальные запчасти.Варочная панель Bosch не работает? Обратитесь к нам для ремонта варочных панелей. Мы предоставляем бесплатную диагностику, ремонт на дому и гарантию 1 год. Наши специалисты с многолетним опытом быстро устранят любые неисправности, используя оригинальные запчасти.

l free to adjust these comments as needed to better fit the specific blog posts you’re responding to!dashdome

Думаете, займ с убитой кредитной историей недоступен? Вовсе нет! В Telegram-канале Займы с плохой КИ вы найдете предложения, которые помогут вам получить деньги даже в самых сложных ситуациях. Кредиторы готовы предоставить займ быстро и без отказов. Подписывайтесь и решите свои финансовые проблемы!

Цветоимпульсная терапия — это эффективный метод лечения, который широко используется в клинике AllegroVision – массаж для детей ижевск .ru. Наша клиника гордится тем, что у нас работают только лучшие специалисты с опытом более 10 лет. Цветоимпульсная терапия помогает при различных зрительных расстройствах, используя световые импульсы разных цветов для улучшения зрения и общего состояния глаз. Этот метод безопасен и подходит как детям, так и взрослым.

В AllegroVision – проверка зрения ижевск мы предлагаем лучшие условия и множество вариантов оплаты, чтобы сделать лечение доступным для всех. Наши врачи тщательно подбирают индивидуальные программы терапии, учитывая все особенности здоровья пациента. Мы уверены, что наша клиника предоставит вам высочайший уровень медицинских услуг и заботы о вашем зрении.

Недавно возникла необходимость сделать ремонт в квартире. Сумма, которую мне нужно было собрать, составляла 25 тысяч рублей. Обращаться в банк не хотелось из-за длительных процедур и возможных отказов. В поисках быстрого решения я наткнулся на канал https://t.me/s/novue_zaimu, где было много новых займов, которые предоставляют деньги без отказа. Это оказалось идеальным вариантом. Я узнал, как правильно выбирать МФО и как заполнять заявки, что значительно ускорило процесс. В итоге, я получил деньги на ремонт без лишних хлопот и задержек.

Диагностика развития детей с нарушением зрения — важный шаг для определения состояния и выбора правильного лечения. В клинике AllegroVision – консультация детского психолога .ru специалисты проводят комплексные обследования, которые включают разнообразные тесты и методы, направленные на выявление проблем со зрением у детей. Это помогает не только определить степень нарушения, но и понять, как оно влияет на общее развитие ребенка.

Ранняя диагностика позволяет своевременно начать лечение и минимизировать влияние проблем со зрением на обучение и социальную адаптацию ребенка. В AllegroVision – нейропсихологическая диагностика школьников используют современное оборудование и методы, что гарантирует точные результаты и эффективное лечение.

This post is so interesting. I can’t wait to read more from you.

Ёмкости для канализации в Екатеринбурге neseptik.com

По вопросу емкости для канализации 20 кубов екатеринбург мы Вам обязательно окажем помощь. Сегодня внушительнс спросом пользуются загородные дома, дачи, таунхаусы. Жители как будто измотались от социальной жизни и все рвутся к уединению и комфортной обстановке за городом. Но на этапе выбора и покупки участка, рекомендуем учесть очень многие нюансы, а именно вопрос с водоотведением. Если Вы обратитесь к нам перед стройкой, то это будет одним из лучших решений в Вашей жизни!

Претенденты смотреть Претенденты фильм, 2024, смотреть онлайн

azithromycin tabs 250mg

Благодарю за отличную информацию!

В свою очередь предлагаю зарубиться в рулетку!

игровые автоматы vavada — быстро и просто. Это допустит вас к к огромному количеству слотов и рулетке.

Создав аккаунт вы попадете в свой ЛК и начать играть. Обратите внимание, что для вывода выигрышей вам необходимо будет подтвердить свою личность, предоставив документы.

Установка крыши на балконы спб specbalkon.ru

Если Вам нужно замена алюминиевого остекления прямо сегодня, то мы вам непременно поможем. Услуга по замене холодного фасадного остекления по теплое в данный момент весьма востребована. При покупке жилья в новом доме очень часто застройщик ставит на балкон холодное, не очень хорошее остекление, которое лучше поменять сразу же после покупки. Теплое остекление балкона имеет большое количество преимуществ: окна не замерзнут даже в самые холодные зимы, на балконе возможно сделать любое помещение, цветы будут расти при комфортной температуре, на балконе можно продумать места для хранения и вещи не деформируются. Поэтому предлагаем Вам замену остекления сделать как можно быстрее и по выигрышной цене.

Благодарю за полезную инфу!

В свою очередь предлагаю поиграть в настоящее казино!

официальный сайт vavada — доступно и быстро. Это допустит вас к к огромному количеству слотов и рулетке.

Зарегистрировавшись вы войдете в свой ЛК и начнете захватывающую игру. Не забудьте, что для вывода выигранных денег нужно пройти верификацию аккаунта, предоставив документы.

You consistently produce high-quality content that is both informative and enjoyable to read. This post was no exception. Keep it up!pulsepeak

Замена панорамного остекления на теплое specbalkon.ru

Если Вам необходимо фасадное остекление алюминием прямо сегодня, то мы вам обязательно поможем. Услуга по смене холодного фасадного остекления по теплое сейчас весьма востребована. При покупке квартиры в новом доме очень часто застройщик устанавливает на балкон холодное, не очень хорошее остекление, которое лучше всего поменять сразу же после приобретения. Теплое остекление лоджии имеет большое количество плюсов: окна не замерзнут даже в самые холодные зимы, на балконе возможно сделать отдельное помещение, цветы будут стоять при комнатной температуре, на балконе можно продумать места для хранения и вещи не деформируются. Поэтому предлагаем Вам замену остекления сделать как можно скорее и по лучшей цене.

Привет всем! Хотел бы поделиться телеграм-каналами, которые реально помогают мне в жизни. Для киноманов у меня всегда под рукой новинки кино 2024 – там всегда свежие обзоры и рекомендации. Для заработка онлайн я читаю заработок в интернете – реально полезный контент. Для саморазвития очень рекомендую канал саморазвитие с чего начать. А если нужны срочные финансовые решения, то новые МФО 2024 и займы которые дают всем помогут всегда. Рекомендую!

doxycycline 200 mg price

Обучение дистанционно maps-edu.ru

По вопросу педагогика повышение квалификации дистанционно онлайн, мы Вам обязательно поможем. Звоните по контактному телефону 8(800)777-06-74 и задавайте все оставшиеся вопросы. Звонок по РФ бесплатный. Территориально расположены по адресу: г. Иркутск, ул. Степана Разина, д. 6. На веб портале maps-edu.ru вы также можете обратиться в службу поддержки и Вас проконсультирует наш менеджер.

Аккредитация врачей maps-edu.ru

По вопросу курсы менеджера по закупкам онлайн, мы Вам непременно окажем помощь. Звоните по телефону 8(800)777-06-74 и задавайте все возникшие вопросы. Звонок по России бесплатный. Территориально находимся по адресу: г. Иркутск, ул. Степана Разина, д. 6. На веб портале maps-edu.ru вы также можете обратиться в службу поддержки и Вас проконсультирует наш специалист.

There is clearly a bunch to identify about this. I suppose you made certain good points in features also.

Срочно нужны деньги? Канал срочные займы поможет вам найти выход из любой ситуации! Оформляйте займ на карту без отказа срочно и без проверок. Подписывайтесь и получайте деньги быстро и надежно!

Fantastic website, Simply wanted in order to opinion will not connect with the actual rss or atom flow, you may want set up the proper extension for your in order to workthat.

Thank you, I have recently been seeking for facts about this subject matter for ages and yours is the best I have found so far.

На канале Кредиты на карту онлайн вы найдете более 15 предложений с разными условиями. Мы гарантируем, что каждый получит кредит на карту, даже если у вас плохая кредитная история. Подписывайтесь и выбирайте лучший кредит для себя, без отказов и задержек!

Looking for a fun way to spend our evening, my girlfriend and I searched Google for adult comics and found Mult34 – porn comix . We were delighted by the wide array of erotic comics available for free. We spent hours immersed in different stories, each one more exciting than the last.

Mult34 – family guy porn stands out with its impressive content and diverse selection. It’s a fantastic site for couples seeking quality adult entertainment. We highly recommend Mult34 – rule 34 website for an enjoyable and memorable evening. We had a blast and will be returning soon.

На канале Потребительские кредиты – вся информация мы делимся всеми предложениями рынка. Хотите знать, где выгоднее взять кредит? Интересуетесь рисками и условиями? У нас есть ответы на все ваши вопросы. Подписывайтесь и получайте актуальную информацию!

My girlfriend and I wanted to find some exciting adult comics to enjoy together. A quick Google search brought us to Mult34 – porn manga , and we were amazed by the vast collection. We spent the whole night exploring the site, and each comic we read was thrilling.

Mult34 – harley quinn porn offers top-notch content that’s perfect for spicing up any evening. The variety and quality of the comics are unmatched. If you’re looking for something fun and free, Mult34 – succubus porn is the perfect choice. We had a fantastic time and can’t wait to come back for more.

Great post.

Новые займы в СПБ – ваш путеводитель в мире выгодных онлайн займов. Мы собрали лучшие предложения от новых МФО, которые выдают займы без отказов. Неважно, есть ли у вас работа или плохая кредитная история, вы можете получить до 30 000 рублей. Первый займ часто под 0%, что делает его еще более привлекательным. Присоединяйтесь к нашему каналу и выбирайте самые выгодные условия.

Новые займы в СПБ – ваш надежный источник информации о самых выгодных займах на карту онлайн. Мы собрали новейшие предложения от МФО, которые выдают займы без отказов и проверок. Неважно, есть ли у вас работа или плохая кредитная история, вы можете получить до 30 000 рублей. Первый займ под 0% – отличный способ улучшить ваш кредитный рейтинг. Подписывайтесь на наш канал и находите самые выгодные условия для получения займа.

Hello! Do you know if they make any plugins to assist with Search Engine Optimization? I’m trying to

get my blog to rank for some targeted keywords but I’m not seeing very good success.

If you know of any please share. Many thanks! You can read similar art here: Escape room list

I’ll right away snatch your rss as I can’t in finding your email subscription link or e-newsletter service. Do you have any? Please permit me recognize so that I could subscribe. Thanks!

Very efficiently written story. It will be valuable to everyone who employess it, as well as me. Keep up the good work – can’r wait to read more posts.

Китайские дорамы — это настоящие шедевры азиатского кинематографа, которые пленяют зрителей своими увлекательными сюжетами и яркими персонажами. На сайте doramaserials.net вы можете китайские дорамы смотреть онлайн в высоком качестве и без надоедливой рекламы. Независимо от того, интересуетесь ли вы романтическими историями, драмами или приключенческими сериалами, здесь каждый найдет что-то для себя.

Преимущество сайта doramaserials.net в том, что все китайские дорамы с русской озвучкой, что делает просмотр еще более удобным и увлекательным. Окунитесь в мир восточной культуры и наслаждайтесь великолепной актерской игрой, не отвлекаясь на субтитры. Удобный интерфейс и регулярные обновления каталога позволят вам всегда быть в курсе последних новинок. Присоединяйтесь к миллионам поклонников китайских дорам и откройте для себя волшебный мир азиатских сериалов!

Vavada – топовая онлайн площадка, предлагающая широкий ассортимент увлекательных игровых аппаратов, призванных подарить невероятные ощущения от азартных игр. С более чем 600 наименованиями в базе сайта Vavada удовлетворит игровые предпочтения каждого.

vavada игровые автоматы официальный – отличный выбор для тех, кто ищет незабываемый и разнообразный игровой опыт. С обширным каталогом, высококачественной графикой, отличными плюшками и безкомпромиссной репутацией Вавада обеспечивает бесконечные часы развлечений для игроков всех уровней.

Согласование перепланировки зданий в Москве alma-stroi.ru

Перепланировка здания — один из самых главных этапов в ремонте разных объектов. Но в нашей стране, она непременно должна быть узаконена и сделана по всем стандартам. Мы знаем о перепланировках всё, читайте на сайте alma-stroi.ru уже сейчас.

По теме сколько стоит согласование перепланировки мы поможем Вам. Если у Вас уже проведена несанкционированная перепланировка без документов, то это не беда. Её также возможно узаконить и с легкостью пользоваться помещениями. Не всегда расстановка комнат в доме или производственных помещениях удовлетворяет владельца. Но в последнее время, перепланировка просто превосходный выход из ситуации. Конечно, выгоднее всего ее осуществлять на этапе начального ремонта, но если этого не случилось, то её можно сделать на каждом этапе эксплуатирования.

Цена перепланировки можно посмотреть на веб сайте alma-stroi.ru или посмотреть примеры выполненных работ. Мы работаем в представленной области уже много лет и имеем множество счастливых клиентов и выполненных работ. К каждому проекту имеем персональный подход и учитываем все желания клиента. Также работаем четко в срок и по очень выгодным ценам.

Заказать услуги по узакониванию перепланировки можно уже сейчас. Наши работники приедут к Вам для измерения помещений и выявления размера работы. И после этого будет названа окончательная цена и дата выполнения работ. Перепланировка — это отличный шанс сделать собственную жизнь удобнее.

Любите азиатские сериалы, но не хотите отвлекаться на субтитры? На сайте doramaserials.net вы найдете дорамы с русской озвучкой, которые позволят полностью погрузиться в сюжет и насладиться великолепной актерской игрой. Сайт предлагает широкий выбор сериалов различных жанров: от романтических историй до захватывающих детективов. Теперь вы можете смотреть любимые дорамы без языкового барьера и получать настоящее удовольствие от просмотра.

Кроме того, на doramaserials.net доступны дорамы в хорошем качестве. Высокое разрешение видео и качественный звук делают просмотр еще более приятным. Вам не придется беспокоиться о низком качестве изображения или частых прерываниях. Просто выберите интересующий вас сериал и наслаждайтесь захватывающими историями и яркими персонажами. Присоединяйтесь к миллионам поклонников дорам и открывайте для себя новый мир азиатского кинематографа!

My spouse and i were absolutely happy when Jordan managed to finish off his preliminary research because of the ideas he got through your blog. It’s not at all simplistic to simply happen to be handing out ideas that many others may have been selling. We do know we have got the website owner to give thanks to for this. The specific illustrations you’ve made, the simple web site menu, the relationships you help to promote – it is all sensational, and it’s letting our son in addition to us recognize that this subject matter is entertaining, and that is extraordinarily fundamental. Thank you for all!

Vavada – топовая онлайн площадка, предлагающая широкий ассортимент интереснейших игровых аппаратов, призванных дать невероятные впечатления от азартных игр. С более чем 600 наименованиями в каталоге Вавада удовлетворит игровые предпочтения каждого.

играть в вавада игровые автоматы – идеальный выбор для тех, кто ищет захватывающий и разного рода игровой опыт. С большой базой, высококачественной графикой, щедрыми плюшками и надежной репутацией Вавада дает бесконечные часы развлекухи для игроков любого уровня.

Хотите узнать самые горячие новости из мира бокса? Octagon Express представляет вам главные новости бокса на сегодня! Свежие интервью, захватывающие видео и аналитические обзоры – все это ждет вас на нашем сайте. Следите за всеми важными событиями и не пропустите ни одной сенсации. Подписывайтесь на обновления и будьте первым, кто узнает все последние новости из мира бокса вместе с Octagon Express!

Интересуетесь предстоящими поединками? На Octagon Express вы найдете актуальное расписание боев бокса. Не пропустите ни одного важного события! Узнавайте даты и время боев, чтобы быть в курсе всех значимых мероприятий. Подписывайтесь на обновления и следите за всеми поединками вместе с Octagon Express. Оставайтесь в центре событий и наслаждайтесь захватывающими боями!

Платформа Dragon money предлагает уникальный набор азартных игр. Использование промокодов позволит вам получить дополнительные выгоды и привилегии. Каждый найдет здесь vk.com/dragon_money_promokod что-то по душе, включая самых опытных игроков. В этом сообществе я нашел множество бездепозитных промокодов.

Какие игры и занятия вы считаете наиболее полезными для развития сахарный поссум?

Будьте всегда в курсе всех событий в мире бокса с Octagon Express! На нашем сайте вы найдете главные новости бокса на сегодня. Мы предлагаем свежие интервью с бойцами, подробные обзоры боев и аналитические статьи от экспертов. Получайте самую актуальную информацию о предстоящих поединках и результатах боев. Оставайтесь на шаг впереди и не пропустите ни одной важной новости. Подпишитесь на обновления и следите за всеми событиями вместе с Octagon Express!

Если вы хотите снять шлюху в Донецке, заходите на сайт intimdnr.com – заказать проститутку на час . У нас представлен широкий выбор проверенных девушек, готовых подарить вам незабываемые моменты. Все анкеты содержат подробные фото и информацию, чтобы вы могли сделать осознанный выбор. Мы гарантируем высокий уровень сервиса и полную конфиденциальность. Выбирайте понравившуюся шлюху и оставляйте заявку на сайте. На intimdnr.com – шлюхи по вызову выезд вы легко найдете идеальную спутницу, которая удовлетворит все ваши желания. Наслаждайтесь качественным сервисом и приятным общением с нашими девушками в Донецке.

Slightly off topic :)

It so happened that my sister found an interesting man here, and recently got married ^_^

(Admin, don’t troll!!!)

Is there are handsome people here! ;) I’m Maria, 27 years old.

I work as a model, successfull – I hope you do too! Although, if you are very good in bed, then you are out of the queue!)))

By the way, there was no sex for a long time, it is very difficult to find a decent one…

And no! I am not a prostitute! I prefer harmonious, warm and reliable relationships. I cook deliciously and not only ;) I have a degree in marketing.

My photo:

___

Added

The photo is broken, sorry(((

Check out my blog where you’ll find lots of hot information about me:

https://katalepsy.ru

Or write to me in telegram @Lolla_sm1_best ( start chat with your photo!!!)

It was some sort of pleasure locating your site a short while ago. I came up here right now hoping to come across interesting things. And I was not dissatisfied. Your ideas about new approaches on this subject were topical and a good help to myself. Thank you for making time to write down these things plus for sharing your notions.

Your method of telling the whole thing in this paragraph is really fastidious,

every one can easily be aware of it, Thanks a lot.

Good day! Do you know if they make any plugins to help

with SEO? I’m trying to get my site to rank for some targeted keywords but I’m not seeing

very good results. If you know of any please share. Many thanks!

I saw similar blog here: blogexpander.com

Die neuesten Studien zeigen, dass der Reduslim Test negativ ausfällt. Viele Menschen waren gespannt auf die Ergebnisse, da das Produkt als Wundermittel zum Abnehmen angepriesen wurde. Doch leider konnte die versprochene Wirkung nicht bestätigt werden. Trotzdem sollten wir nicht vergessen, dass es keine Wunderpille gibt, die uns über Nacht schlank macht. Gesunde Ernährung und regelmäßige Bewegung bleiben die Schlüssel zum Erfolg. Reduslim mag nicht die gewünschten Resultate liefern, aber es gibt viele andere Möglichkeiten, um sein Gewicht zu reduzieren und sein Wohlbefinden zu steigern. Bleiben wir also realistisch und setzen auf nachhaltige Methoden, um unsere Ziele zu erreichen.

Stop by my page – https://reduslim.at/

Если вас интересует цена на секс с проститутками, посетите сайт intimdnr.com – заказать проститутку на час . У нас представлен широкий выбор девушек на любой вкус и цвет, а также прозрачная система ценообразования. Вы сможете найти привлекательных и профессиональных проституток по доступным ценам. Все наши девушки тщательно отобраны и прошли проверку, чтобы гарантировать высокий уровень сервиса и полную конфиденциальность. На intimdnr.com – жигало цена вы найдете все необходимые детали, включая цену за услуги. Выберите понравившуюся девушку и наслаждайтесь незабываемыми моментами с проверенными профессионалами.

propecia online singapore

can you buy doxycycline

how to get azithromycin online

drug furosemide 20 mg

Ментальная структура и динамика коммуникативного мира личности и популярные статьи по психологии.

can jobs for teens

https://mcscap.ru/bitrix/redirect.php?goto=https://tubesweet.com/

https://idfashionru.alfer.group/bitrix/redirect.php?goto=https://tubesweet.com/

https://platforma.bz/bitrix/redirect.php?goto=https://tubesweet.com/

https://mobile.myprice74.ru/redirect.php?url=tubesweet.com/

На сайте turkvideo.tv вы можете смотреть турецкие сериалы на русском языке в отличном качестве. Насладитесь лучшими произведениями турецкого кинематографа с качественной озвучкой и без рекламы перед просмотром. Погружайтесь в увлекательные сюжеты и переживайте вместе с героями. Мы гордимся тем, что занимаем ТОП 1 в поиске Yandex, предлагая только лучший контент. Начните свое путешествие в мир турецких сериалов прямо сейчас на turkvideo.tv!

Приобрести бурение скважин можно на веб портале мастер-буров.рф прямо сейчас. Скважина с питьевой водой — один из важных компонентов на Вашем участке. Мы гарантируем качество проделанной работы, материалов, а также осуществляем гарантийное обслуживание. Наружние факторы могут негативно влиять на скважину и качество воды, мы также работаем с восстановлением поврежденных скважин от разрушения и с очищением от заиливания. Звоните, приходите, будем рады с Вами сотрудничать.

Ищете индивидуалок в Донецке? Посетите сайт intimdnr.com – снять проститутку и выберите из множества очаровательных девушек. Мы предлагаем профессиональных и красивых индивидуалок, готовых воплотить в жизнь ваши самые смелые фантазии. Все наши девушки проходят строгий отбор, чтобы гарантировать вам высокий уровень сервиса и полную конфиденциальность. Просто выберите понравившуюся девушку, оставьте заявку и наслаждайтесь незабываемыми моментами. На intimdnr.com – элитные индивидуалки заказать вы найдете индивидуалок в Донецке, которые сделают ваш вечер особенным.

Готовы к новым приключениям и драмам? На сайте turkvideo.tv вы найдете самые свежие и захватывающие турецкие сериалы 2024. Погружайтесь в мир новых историй и интриг, наслаждаясь великолепной игрой актеров и высококачественной озвучкой. Откройте для себя новые сюжеты, которые заставят вас переживать и радоваться вместе с героями. Не упустите возможность быть в курсе всех новинок турецкого кинематографа, начните смотреть уже сегодня!

accutane 20mg capsules

Hi there to every body, it’s my first pay a visit of this website; this webpage consists of remarkable and truly excellent information for readers.

купить диплом в клинцах

http://mockwa.com/forum/thread-146281/

купить диплом в каспийске

Купить Кокаин в Москве? Самый чистый Кокаин в Москве Купить

ССЫЛКА НА САЙТ- https://mephedrone.top

Москва Купить Мефедрон? Кристаллы МЕФ?

Где в Москве Купить Мефедрон? САЙТ – https://mephedrone.top/

Hi! I just want to give you a huge thumbs up for the excellent info you’ve got here on this post. I am returning to your web site for more soon.

price lyrica 300 mg

can i buy clomid over the counter in australia

baclofen pills 025 mg

furosemide 500 mg

propecia cost comparison

lyrica 75 mg capsule

generic baclofen tablet

retin a 25 gel

where to get flomax

There s presently no recognized recommendation for treatment duration or frequency best place to buy cialis online forum NUTRISON ENERGY 0 ND Pack x 1 x 1000 ml

Добро пожаловать в студию ландшафтного дизайна Green History! Мы предлагаем полный спектр услуг по благоустройству и озеленению территорий. От уникальных ландшафтных проектов до установки систем автоматического полива – мы делаем всё для создания уютных и красивых садов. Посетите наш сайт greenhistory.ru и узнайте больше о наших услугах. Наш офис находится по адресу: г. Москва, Дмитровское шоссе, дом 100, корп 2, офис 418.

Вы мечтаете о прекрасном саде? Green History воплотит ваши мечты в реальность! Мы используем только лучшие материалы и современные технологии для создания уникальных ландшафтных решений. Свяжитесь с нами через сайт greenhistory.ru или посетите нас по адресу: г. Москва, Дмитровское шоссе, дом 100, корп 2, офис 418. Превратите свой участок в настоящий оазис с нашей помощью!

diflucan 150 mg caps

10mg baclofen tablet price

купить диплом училища купить диплом училища .

Erectile dysfunction treatments available online from TruePills.

Discreet, next day delivery and lowest price guarantee.

Viagra is a well-known, branded and common erectile dysfunction (ED) treatment for men.

It’s available through our Online TruePills service.

Trial ED Pack consists of the following ED drugs:

Viagra Active Ingredient: Sildenafil 100mg 5 pills

Cialis 20mg 5 pills

Levitra 20mg 5 pills

https://cutt.ly/dw7ChH4s

https://istlight.ru/bitrix/redirect.php?goto=https://true-pill.top/

http://sovik.ru/bitrix/redirect.php?goto=https://true-pill.top/

https://le17septembre.co.kr/member/login.html?returnUrl=https://true-pill.top/

http://ww9.aitsafe.com/cf/add.cfm?userid=B6167911&product=One%20and%20a%20half%20hour%20massage%20spa%20package%20&price=150.00&return=true-pill.top/

http://avgd.su/bitrix/redirect.php?goto=https://true-pill.top/

Novo-ranidine

Vistaril

MГ©bendazole

Amacin

Rahistin

Cloranfenicol fabra

Eromycin

Xergic

Parmid

Teveten plus

Epilepax

Parkiston

Sadin

Macromax

Canaural

Ranitizane

Erycinum

Vasocardol

Herpomed

Dexoral

Wincocef

Nor-dacef

Femsept

Biatron

Panto

Antipres

Lebensart

Norveta

Sacona

Meditam

Trastocir

Pyrethia

Onsenal

Protolan

Exelon

Adimet

Diaglitab

Claversal

Gestapuran

Virux

buy propecia online without prescription

За более чем 15 лет работы Green History стала символом качества и профессионализма в мире ландшафтного дизайна. Мы предлагаем полный комплекс услуг: от проектирования уникальных ландшафтных решений до установки систем автоматического полива и мощения дорожек. Наши специалисты создают идеальные газоны и озеленяют территории, превращая их в настоящие произведения искусства. Посетите наш сайт greenhistory.ru или наш офис в Москве: Дмитровское шоссе, дом 100, корп 2, офис 418.

Мы гордимся своим опытом и вниманием к деталям. Каждый проект для нас – это возможность создать что-то уникальное и красивое. Используя лучшие материалы и новейшие технологии, мы гарантируем долговечность и эстетическую привлекательность наших решений. За более подробной информацией заходите на greenhistory.ru или приходите к нам в офис по адресу: г. Москва, Дмитровское шоссе, дом 100, корп 2, офис 418. Превратите свой сад в оазис вместе с Green History.

amoxicillin 400 mg

where to buy accutane

buy zovirax tablets online

3 diflucan pills

Store Grownup Sex Toys Best Vibrators For Girls I was a Girlfriend Girl, a Relationship

Person, and when one broke up it was normally as a end result of another had

caught my eye – and if not, it definitely wasn’t far behind.

adult toys

strap on

wholesale vibrator

horse dildo

adult toys

g spot vibrator

penis pump

strap on

animal dildo

sex toys

dildo

adult store

sex toys

strap on

strap on

sex shop

cock ring

Realistic Dildo

vibrators

wholesale dildos

wholesale sex toys

wholesale dildo

adult store

horse dildo

cock ring

Turn $1 into $100 instantly. Use the financial Robot. https://t.me/cryptaxbot/11

Если вам нравятся турецкие сериалы драмы, то turkline.tv – это то, что вам нужно. Я обожаю смотреть здесь сериалы благодаря их качеству HD 1080 и наличию русской озвучки. Это делает просмотр комфортным и захватывающим. На сайте представлены такие потрясающие драмы, как “Запретный плод” и “Жестокий Стамбул”. Каждая серия приносит массу эмоций и держит в напряжении до последней минуты. Турклайн.тв – идеальное место для любителей качественных драм.

cialis without prescription canada

Premium Luxury Silicone Sex Toys + Adult Toys In enterprise since 1977

when sex educator Joani Blank launched the enterprise as a San Francisco

boutique that distinguished itself from intercourse shops of the day by focusing

on ladies’s pleasure and.

cheap sex toys

penis pump

sex shop

wholesale dildo

vibrator

gay sex toys

vibrators

wholesale vibrator

wholesale sex toys

dildos

wholesale vibrator

penis pump

penis pump

dildo

wholesale sex toys

sex toys

dildos

Realistic Dildo

vibrator

wholesale sex toys

cock ring

animal dildo

sex toys

vibrator

g spot vibrator

Old man with young wife. Donald Trump Approves —> http://zi.ma/4h6w89/

Get new tokens in the game now Hamster Kombat

daily distribution Notcoin to your wallets

Join our project notreward.pro and receive toncoin

Claim Notcoin

Когда я искал, где можно смотреть турецкие сериалы на русском языке, нашел turkline.tv. Этот сайт занимает первые позиции в Google и Yandex, и не зря. Здесь все сериалы в HD качестве, без рекламы и на русском языке. Удобный интерфейс и разнообразие жанров делают просмотр комфортным и увлекательным. Очень рад, что нашел этот сайт и рекомендую его всем любителям турецкого кино. Турклайн.тв стал моим фаворитом для вечернего досуга.

Обучение по охране труда safetysystemsgroup.com

Помимо общие требования к аккредитации испытательных лабораторий у нас Вы сможете пройти курсы по обучению дистанционно по охране труда, пожарно-технический минимум, электробезопасность 2-я группа и другие. Свяжитесь с нами по вышеуказанному телефону, адресу или закажите возвратный звонок. Мы будем рады работать с Вами.

acyclovir 200 mg price

Онлайн обучение по охране труда safetysystemsgroup.com

Помимо обязательная аккредитация испытательных лабораторий у нас Вы найдете курсы по обучению дистанционно по охране труда, пожарно-технический минимум, электробезопасность 2-я группа и другие. Свяжитесь с нами по вышеуказанному номеру телефона, адресу или закажите возвратный звонок. Мы будем рады работать с Вами.

accutane cost in canada

furosemide 50 mg daily

Если вы предпочитаете турецкие сериалы боевики, загляните на turkline.tv. Здесь вы найдете захватывающие сериалы в жанре боевик, такие как “Марашлы” и “Воин”. Все сериалы доступны в HD 1080 качестве и с русской озвучкой, что делает просмотр особенно приятным. Меня всегда привлекает динамичный сюжет и яркие сцены. Турклайн.тв предлагает лучшие боевики, которые захватят ваше внимание с первой минуты. Этот сайт – настоящий клад для поклонников турецких боевиков.

Ready to experience the excitement of video poker? Join our online poker games free and start playing today. Whether you’re a novice or a seasoned poker player, our video poker games offer something for everyone. Embrace the challenge, apply your strategy, and enjoy the thrill of winning.

lasix tablet

how much is azithromycin 250 mg

furosemide 40 mg for sale

where can i buy vermox

Turklife.tv – ваш идеальный спутник для просмотра турецкие сериалы новинки. Сайт предлагает широкий выбор новых сериалов 2024 года в HD 1080 качестве с русской озвучкой. Все сериалы удобно разбиты по жанрам, что делает поиск еще проще.

Сайт обновляется ежедневно, добавляя свежие серии, и всё это бесплатно и без регистрации. Наслаждайтесь последними новинками турецких сериалов на turklife.tv без лишних хлопот и рекламы!

vermox price south africa

Захватывающие истории, полные эмоций и драмы, ждут вас на turklife.tv! Турецкие сериалы драмы в HD 1080 качестве с профессиональной русской озвучкой подарят вам незабываемые впечатления. Удобное разделение по жанрам и годам позволит быстро найти любимый сериал.

Каждый день на сайте появляются новые серии, и всё это абсолютно бесплатно и без рекламы. Turklife.tv – ваш идеальный выбор для просмотра драматических сериалов. Откройте для себя лучшие турецкие драмы прямо сейчас!

25mg modafinil

buy azithromycin online cheap

lioresal 10mg

Мониторинг обменников криптовалют Обменник – незаменимый помощник в сфере обмена криптовалют на выгодных условиях. У нас вы найдете самые актуальные и надежные обменные пункты, которые предлагают лучшие курсы криптовалют.

Основная цель нашего сайта заключается в том, чтобы облегчить для пользователей процесс обмена криптовалюты и помогать выполнять выгодный обмен криптовалют спустя обменники по всему миру. Мы понимаем, что комиссии обменных сервисов могут значительно влиять на ваше постановление при выборе партнера для обмена. Именно оттого мы предлагаем детальный мониторинг обменников криптовалют, сравнивая предоставляемые ими условия, дабы вы могли содеять обмен наиболее выгодным образом. Информацию о комиссии или других специальных условиях при проведении обмена, вы увидите в условных обозначениях насупротив обменника. Для этого вам необходимо выбрать токены в полях “Отдаете” и “Получаете”.

https://wik.co.kr/master4/1030045 юми цена сегодня в рублях криптовалюта

С помощью нашего сайта вы легко найдете надежные обменники, которые предлагают наилучшие курсы обмена криптовалют. Вы сможете использовать наш встроенный калькулятор обмена криптовалют для быстрого расчета суммы вашей сделки в фиатных средствах и криптовалютах. Это покойный инструмент, кой поможет вам рассчитать точную сумму обмена и отдаваемой криптовалюты с учетом лимитов обменных пунктов.

Благодаря нашему мониторингу криптовалют вы с легкостью сможете реализовать криптовалюту или достать её онлайн и офлайн по лучшему курсу. Мы дорожим своей репутацией и тщательно проверяем обменники, чтобы удостовериться в их надежности и безопасности.

Мы стремимся предоставить вам всего самые лучшие обменники, дабы ваш проба обмена был безопасным, удобным и выгодным. Мошенники не проходят проверку обменника, подтверждение личности и регулярное тестирование работы сервисов.

Мы помогаем нашим пользователям на пути к успешным операциям с криптовалютами или изучению рынка крипты.

Наш сайт предоставляет полезные инструменты для выбора обменников, максимально соответствующих потребностям наших пользователей:

исключительно надежные токены, статус которых подтвержден биржей;

приобретение криптовалюты с банковской карты;

доставание криптовалюты за наличные;

обмен одной криптовалюты на другую;

быстрая обработка сделок и качественная работа службы поддержки.

Покупка и торговля криптовалюты по выгодной цене

Одной из ключевых услуг, которые предлагают обменники, является обмен биткоина или usdt на наличные. Наш мониторинг обеспечивает доступ к самым актуальным и выгодным курсам обмена валют, т.к. парсинг курсов Обменник обновляет курсы криптовалют в режиме реального времени каждые 5 секунд.

Вы сможете эфирно выкопать обменник, кой предлагает наилучший курс обмена криптовалюты на наличные. Это особенно покойно для тех, кто предпочитает провождать операции без использования электронных денег или карт.

Обменник помогает вам при покупке биткоина или usdt за наличные выкроить надежный обменник, который предлагает эту услугу и получить лучшие курсы обмена валют.

Надежные обменники

Мы предлагаем мониторинг курсов надежных обменников с отзывами о них от других пользователей, а также полной информацией об условиях проведения обмена криптовалют, включая доступную сумму для обмена. Это поможет вам получить представление о качестве услуг и надежности обменников.

Кроме того, Обменник предлагает учить дополнительную информацию о криптовалютных кошельках и другие полезные материалы, связанные с обменом криптовалюты. Мы стремимся обеспечить вас всей необходимой информацией о блокчейн технологиях, дабы смастерить ваш эксперимент обмена максимально комфортным и безопасным и осведомленным.

https://gigatree.eu/forum/index.php?topic=113728.0 1 крор это сколько рублей

Мониторинг курсов криптовалют

С помощью платформы и мобильного приложения Обменник вы можете мониторить трансформирование курсов обмена крипты. Все подтвержденные биржами токены представлены для осуществления обмена в разных обменниках и самые актуальные курсы валют.

Какие самые популярные токены и валюты вы можете вырвать с помощью Обменник: Bitcoin BTC, Ethereum ETH, Tether TRC20 (USDT TRC20), Toncoin (TON), Solana (SOL), Dogecoin (DOGE), Avalanche (AVAX), Shiba inu (SHIB), Chainlink (LINK), Dai (DAI), Bitcoin Cash (BCH), Bitcoin SV (BSV), Bitcoin Gold (BTG), Ether Classic (ETC), Litecoin (LTC), Ripple (XRP), Monero (XMR), Dash (DASH), Zcash (ZEC), Tether Omni (USDT OMNI), Tether ERC20 (USDT ERC20), USD Coin (USDC), TrueUSD (TUSD), Paxos (PAX), NEM (XEM), Augur (REP), NEO (NEO), EOS (EOS), Lisk (LSK), Cardano (ADA), Stellar (XLM), TRON (TRX), Waves (WAVES), OmiseGO (OMG), 0x (ZRX), Binance Coin (BNB), ICON (ICX), Komodo (KMD), BitTorrent (BTT) и сила других криптовалют.

https://shikhadabas.com/2024/06/14/crypta-%D0%BE%D0%B1%D0%BC%D0%B5%D0%BD%D0%BD%D0%B8%D0%BA/ калькулятор перевод денег

С помощью Обменник вы можете осуществить транзакцию с оплатой любым удобным для вас способом, например:

наличные USD, наличные RUB, наличные EUR, ЮMoney, Сбербанк, Тинькофф, ВТБ, Альфа-Банк, Райффайзенбанк, Русский Стандарт, Промсвязьбанк, Газпромбанк, Perfect Money, PayPal, Visa, MasterCard или МИР.

Также с помощью крипто платформы Обменник возможна покупка или торг криптовалюты по самому выгодному курсу за наличные с использованием валюты вашей страны.

Так что не теряйте время, пользуйтесь мониторингом обменников Обменник и экономьте копейка и время, при обмене электронных денег, наличных и крипты.

https://clck.ru/3BG4Fi

Представьте себе, в самый неподходящий момент мой телефон сломался. Без него я как без рук – работа, связь с близкими, всё на нем. Денег на новый телефон не было, а у меня уже были просрочки по другим кредитам. В отчаянии я начала искать решения в Яндексе и на первом месте нашла Телеграм канал займ онлайн новые мфо . Это сразу вызвало доверие. На канале были новые МФО, которые давали займы всем, даже с плохой кредитной историей. Оформила займ за 10 минут, и деньги мгновенно поступили на счет. Смогла быстро купить новый телефон и вернуться к нормальной жизни. Всем советую подписаться на этот канал!

order doxycycline no prescription

Rybelsus – Quick and Easy Weight Lass

According to randomised controlled trials, you start losing weight immediately after taking Rybelsus. After one month, the average weight loss on Rybelsus is around 2kg; after two months, it’s over 3kg.

What does Rybelsus do to your body?