REITs, Direct Real Estate, and the Stock Market: Portfolio Diversification Implications

REITs, Direct Real Estate, and the Stock Market: Portfolio Diversification Implications

The philosophy puzzle of a tree falling unnoticed in the forest has a corollary in the investment world. What happens when a longstanding investment question is answered if the market is not listening? A Swiss research paper from 2012 conclusively answers a question that ought to be on the minds of all investors seeking portfolio diversification.

Are REITs real estate?

The question may seem redundant—after all the first two letters of REITs stand for real estate—but it is shorthand for questions involving the relationship of three markets; the general stock market, the direct (i.e. physical) real estate market and REITs. The research into the relationships between these markets yields a surprising answer—actually multiple answers—that should be mandatory reading for anyone building a diversified portfolio. The full paper by authors Hoesli and Oikarinen, which I highly recommend, can be downloaded from the following link Are REITs Real Estate? Evidence from International Sector Level Data.

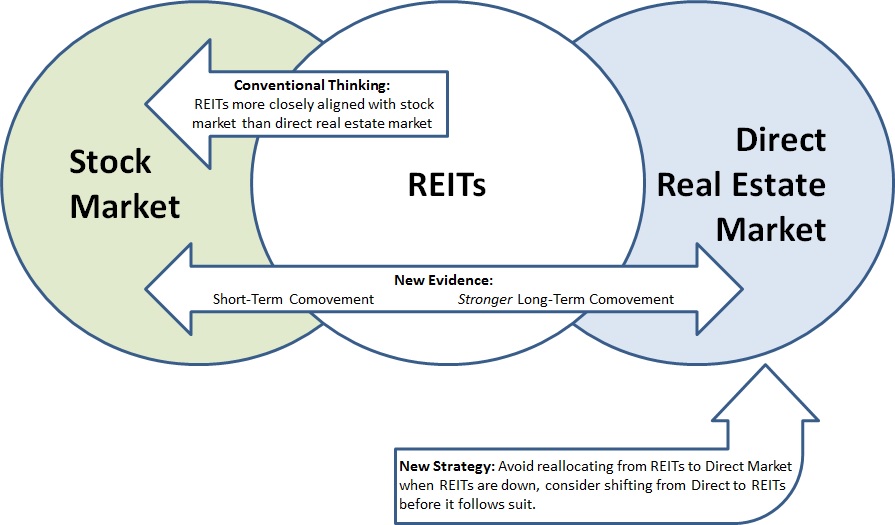

The founding intention of REITs was to provide the average investor with the benefits of investing in real estate while removing many of the hassles associated with physical property. The benefits of REITs over direct real estate (i.e. accessibility, greater liquidity, lower transaction costs, etc.) are not in question. The question is whether investors are falling short in achieving diversification by choosing the convenience of REITs over direct real estate. For the purpose of diversification, REITs become less attractive as an alternative to direct real estate if their performance is more closely aligned with the stock market versus the direct real estate market.

Conventional wisdom has been that REITs behave more like stocks than direct real estate, which was supported by early research. However, this rule-of-thumb now gets a major overhaul thanks to authors Hoesli and Oikarinen. The authors not only performed a meta-review of existing research, they constructed a comprehensive model including data from the United States, the United Kingdom and Australia. They included sector-level data (i.e., instead of relying just on indices) and as an innovative measure, they incorporated economic fundamentals largely ignored by existing research.

In the short-term—less than three to four years—REITs do behave much like stocks, which means that investors may see their REITs going up and down in some degree with the stock market. At a first glance, this apparent comovement may reduce the attractiveness of REITs in the short-term as a tool for diversification in comparison with direct real estate. However, it is what happens long-term where things get interesting.

When looking at time horizons of a minimum of three to four years, REIT performance is significantly more aligned with direct real estate in comparison to the stock market. This is great news for investors seeking diversification through REITs; they can capture the performance of the direct real estate market while receiving the benefits of investing in a security.

Furthermore, it appears that REITs may actually be a kind of early-warning predictor of direct real estate market performance. The inclusion of data from the subprime crisis offered a tantalizing insight into what could become a new rule-of-thumb about when to reallocate. When faced with poor performance in the REITs sector as a whole, the temptation for many investors is to reallocate to direct real estate. The authors show that when the REIT market takes a hit as a whole, investors should anticipate a later, corresponding drop in the direct real estate market. In the case of the subprime crisis, reallocating from REITs to direct real estate was the investing equivalent of running toward the forest fire instead of away from it.

The research suggests that when the REIT sector is depressed overall, investors should consider reallocating from the direct market into REITs, effectively taking advantage of lower prices while avoiding the likely loss of value of their direct real estate assets.

It is surprising that considering the comprehensive and conclusive nature of this research that it does not have far higher market profile. I attribute it to the gap between the academic and investing communities, an oversight that I hope educators will help to overcome turning unconventional wisdom into productive strategies.